Gifts of Real Estate

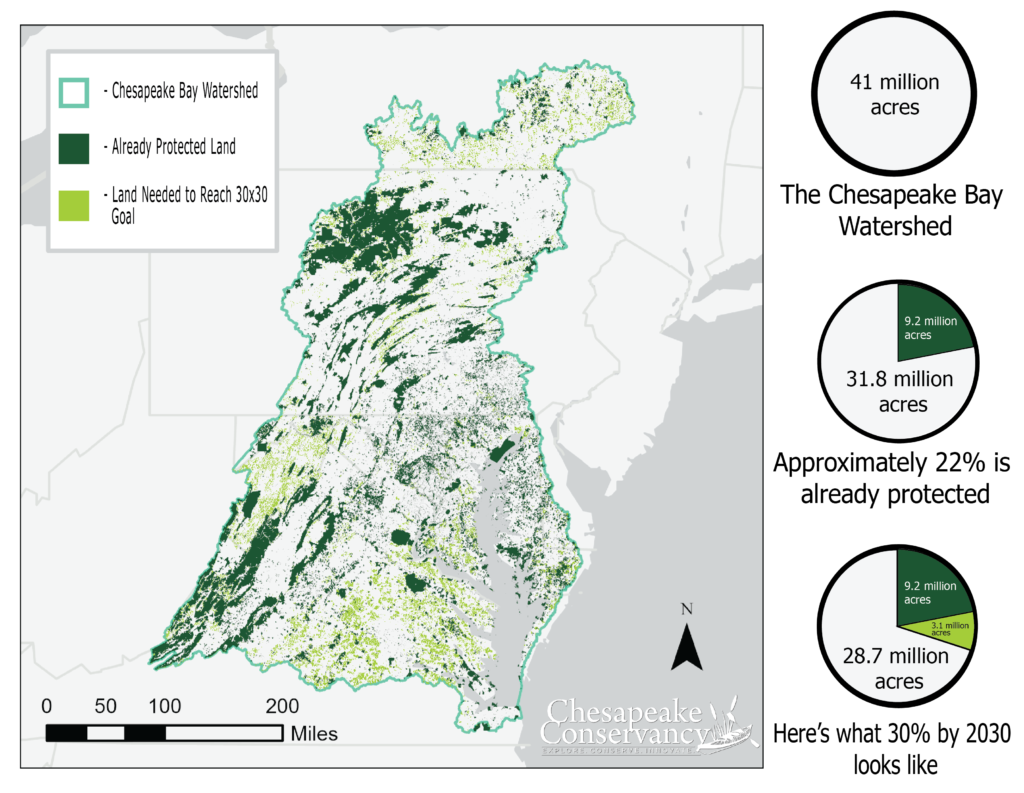

An asset you’ve had for generations can be a gift for generations to come. By donating all or part of your property to Chesapeake Conservancy, you may be able to reduce your capital gains tax, receive an income tax deduction, and receive income for life—and you may even be able to continue to use or live on the property. Best of all, your gift will support vital conservation work to protect the 30% of Chesapeake watershed lands by 2030 (30×30).

Donating land to the Chesapeake Conservancy is the most straightforward method of permanent land protection, and it results in the greatest direct tax benefit for the donor. There are many ways to donate land.

Request Information

Image credit: Jody Couser/Chesapeake Conservancy

DONOR SPOTLIGHT

CHARLES & MARY DANKMEYER

The couple worked with the Chesapeake Conservancy to donate a property they owned on the Eastern Shore that had become a rookery for blue herons.

30×30

Chesapeake Conservancy believes that the Chesapeake conservation community must respond to a regional and global crisis which imminently threatens our natural areas and wildlife by committing to the protection of 30% of the Chesapeake Bay watershed by 2030.

Scientists from around the world have established clear and undeniable evidence of the impending threat to the world’s biodiversity. In the Chesapeake Bay, the environmental community has already devoted substantial resources toward land protection for the health of the Bay, its rivers, and our forests and habitats, but conservationists acknowledge the need to increase efforts in the face of a growing population and rapid land use change.

Image credit: Jerry Edmundson

HOW IT WORKS

Conveying land by gift to Chesapeake Conservancy transfers ownership and management responsibilities from you, the recipient, ends the burden of your property taxes, provides you with maximum income tax and estate tax benefits, and avoids the capital gains tax which would be incurred if you sold the land.

A land donation can be structured to allow you to continue to live on the land by donating a remainder interest and retaining a reserved life estate. You may also choose to donate land by will, continuing to own and control your land during your lifetime, but assuring its protection after your death. Most important, the donated land will be protected in perpetuity.

Here’s the process:

- You deed your property (such as a home, vacation home, commercial building or investment property) to Chesapeake Conservancy.

- The Conservancy will sell the property and use the proceeds to support vital programs. In very limited cases we may use the property for our own purposes.

HOW YOU BENEFIT

- You receive an income tax deduction for the fair market value of the real estate.

- You may reduce or eliminate capital gains taxes owed on an asset.

- Your ownership responsibilities are eliminated.

- You will create an enduring gift for conservation.

- You may be able to make a gift that provides a lifetime of income for you or a beneficiary.

Image credit: Michael Weiss

WAYS TO GIVE

Donating Non-Conservation Real Estate to Generate Conservation Funds

You can generate badly needed funds for conservation purposes by donating real estate of any kind to support the work of Chesapeake Conservancy. Property that does not have special natural features or that is not suited for permanent management by a conservation organization may be a candidate for such a donation. Two easy ways you can generate badly needed funds for open space purchase and protection and reap major tax benefits for yourself are donations of Trade Land and donation of land through a Charitable Remainder Trust.

Click below for more information

Make an Outright Gift of Real Estate

A donated commercial property, or a single-family home, a condominium or other type of real estate can provide tremendous rewards for the non-profit organization, and can create substantial tax benefits for you. The recipient organization can resell the property, subject to appropriate restrictions to protect any conservation values, and use the proceeds to benefit its conservation programs, including the purchase of critical lands elsewhere. This method maintains your real estate in its present form and use, keeps it in private ownership, and on the tax rolls, and allows the land trust to use proceeds from the sale for its conservation work.

Outright Gift of Land

An outright gift of land may be the best conservation strategy for you if:

- You own highly appreciated property

- You have substantial real estate holdings and wish to reduce estate tax burdens

- You do not wish to pass the land on to heirs

- You own property you no longer use

- You own property you cannot now build on – it has become a financial albatross

- You would like to be relieved of the responsibility of managing and caring for the land

- You wish to make a lasting gift to the environment, to your community and to future generations

Advantages of Outright Gifts of Land

- Simplicity and permanence

- If you or family members own or retain adjacent or nearby property, you may benefit from its proximity to conservation land.

- Generally, the fair market value of the donated property is tax-deductible as a charitable contribution.

- You avoid capital gains taxes upon the land.

- You eliminate property taxes on the donated land (after any past and current taxes are paid)

- You reduce the size of your estate, and thereby reduce the amount of state and federal estate taxes.

Donating Land by Will

The donation of land to Chesapeake Conservancy by will (also known as bequests, testamentary gifts, or devises) has become an increasingly popular technique for conserving land.

Advantages of Donating Land by Will

- Ensures conservation of your treasured property, and allows you to enjoy the benefits of full ownership during your lifetime

- Reversibility: you can re-write your will at any time to remove the donation if your financial situation or intentions change.

- Relative simplicity of bequest preparation which avoids detailed negotiations required to determine best income tax deduction on gifts made during your lifetime

- Removes property from your estate, which can significantly reduce estate taxes for your heirs

Donating A Remainder Interest with A Reserved Life Estate

You can donate property during your lifetime, and reserve the right for yourself, and other persons you specifically designate, to continue using the property during your lifetimes. When you and those you have specified either die or release their interests, the land trust/agency assumes full title and control over the property.

How it works:

The value of the gift for tax purposes is the value of the remainder interest, i.e., the length of time reserved for personal use. This is determined by subtracting the value of the reserved life estate (determined from actuarial tables) from the appraised fair market value of the property. The longer the period of reserved use (i.e., the younger the donor or specified holders of the reserved life estate), the lower the value of the remainder interest, and so the value of the gift for tax purposes will be commensurately lower. The values are determined from IRS actuarial tables based on average life expectancies.

Advantages of a Remainder Interest with a Reserved Life Estate

- The income tax advantages of this strategy are less than from an outright donation, but they are greater than from a gift by bequest.

- As a holder of a reserved life estate, you would continue to be responsible for property taxes until the recipient obtains full title to the property

Image credit: Vicki Paulas/CBEC

FOR MORE INFORMATION + NEXT STEPS

- Contact Senior Vice President of Development and Business Strategy, Matthew Provost at 508-317-1695 or [email protected] to discuss the possibility of giving real estate to the Conservancy.

- Seek the advice of your financial or legal advisor to make sure this gift fits your goals.

- If you include the Conservancy in your plans, please use our legal name and federal tax ID.

Legal Name: Chesapeake Conservancy, Inc.

Address: 716 Giddings Ave Suite 42, Annapolis, MD 21403

Federal Tax ID Number: 26-2271377

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor.